Key Takeaways:

- Reverse mortgages must be repaid after certain events, such as the borrower moving out of the home, passing away, or no longer meeting the loan obligations.

- Borrowers and their heirs can resolve the loan by selling the home, refinancing the balance, or using personal funds.

- HECM reverse mortgages include built-in safeguards for borrowers and their heirs.

The repayment process for traditional loans, like home loans or auto loans, is fairly straightforward. You start with a balance and pay it down over a set period of time.

Reverse mortgages, on the other hand, work a bit differently. Instead of making regular monthly payments, the loan balance grows and is repaid in full later, usually after certain conditions are met. That difference is why paying back a reverse mortgage often feels less intuitive—and why it raises questions for many homeowners.

In this guide, let’s break down how reverse mortgage repayment works, what situations may cause a loan to become due, and the options borrowers and their heirs typically have along the way. Whether you’re thinking ahead for yourself or helping a family member navigate the next steps, having a clear picture upfront can help make the process feel more manageable—and help you avoid any unwanted surprises down the road.

The borrower must meet all loan obligations, including living in the property as the principal residence and paying property charges, including property taxes, fees, and hazard insurance. The borrower must maintain the home. If the homeowner does not meet these loan obligations, then the loan will need to be repaid.

Let’s start with an overview.

Reverse mortgage loan basics

A reverse mortgage is a type of loan that allows older homeowners to borrow against their home equity. Unlike a traditional forward mortgage, where you pay the loan down each month, a reverse mortgage loan balance grows over time as interest and fees are added. The loan typically becomes due and payable when you sell the home, move out permanently, pass away, or otherwise fail to meet the loan terms.

Most reverse mortgages have eligibility requirements related to the borrower’s age, the home itself, and the homeowner’s ability to maintain ongoing housing costs. Requirements typically include reaching a minimum age (62 or older for HECMs, 55+ for some proprietary reverse mortgages), living in the home as a primary residence, and having sufficient equity.

Because these loans are secured by the home, borrowers remain responsible for ongoing costs such as property taxes, homeowners insurance, and maintenance.

The right to remain in the home is contingent on paying property taxes and homeowner’s insurance, maintaining the home, and complying with the loan terms.

There are two main categories of reverse mortgages:

- Home equity conversion mortgages (HECMs): This is the most common type of reverse mortgage and is insured by the Federal Housing Administration (FHA). To get a HECM, borrowers must be 62 or older and complete a counseling session with a Housing and Urban Development (HUD)-approved counselor. HECMs have standardized features, federally regulated protections, and loan limits set by the FHA. In 2026, that limit is $1,249,125.

- Proprietary reverse mortgages: This is a private loan option offered by individual lenders. Because it is not regulated by the FHA, a proprietary loan may allow homeowners with higher-valued properties to access more equity and higher loan amounts. Eligibility requirements vary by lender. Closing costs and terms also depend on the lender.

As part of the application process, lenders conduct a financial assessment to ensure borrowers can cover necessary costs, such as property taxes and mortgage insurance premiums.

The borrower must meet all loan obligations, including living in the property as the principal residence and paying property charges, including property taxes, fees, and hazard insurance. The borrower must maintain the home. If the homeowner does not meet these loan obligations, then the loan will need to be repaid.

These materials were not provided by HUD or FHA and were not approved by FHA or any government agency.

→ Learn more about how reverse mortgages work, including eligibility and payout options, in How does a reverse mortgage work?

To learn more, please visit CFPB’s “Reverse Mortgage: A Discussion Guide.”

What triggers a reverse mortgage loan to be repaid?

Reverse mortgages don’t require monthly payments, but the loan balance eventually becomes due under certain circumstances. These situations, often called triggering events, determine when repayment is required. Knowing what they are and what happens next may help borrowers and their families plan ahead.

The borrower must meet all loan obligations, including living in the property as the principal residence and paying property charges, including property taxes, fees, hazard insurance. The borrower must maintain the home. If the homeowner does not meet these loan obligations, then the loan will need to be repaid.

Death of the borrower or eligible non-borrowing spouse

A reverse mortgage loan becomes due when the last surviving borrower dies. If there is more than one borrower on the loan, repayment is not required until the final co-borrower passes away.

HECM loans include spousal protections for certain eligible non-borrowing spouses. If those protections apply, the loan does not become due immediately upon the borrowing spouse’s death, as long as the surviving spouse continues to live in the home as their primary residence and meets the other loan obligations.

Once the last borrower or eligible non-borrowing spouse passes away, heirs usually have a few months to notify the lender, decide whether to keep or sell the home, and begin the repayment process.

The home is no longer the borrower’s primary residence

With a reverse mortgage, the home must remain your primary residence. In general, this means you live there most of the year.

If the borrower moves out permanently or is otherwise absent from the property for more than six months (or 12 consecutive months for medical care), the loan may become due and payable. This can occur if the borrower moves to an assisted living facility or a nursing home. Short-term absences may be allowed, but extended absences usually trigger repayment.

The borrower fails to maintain the home

Borrowers must keep the home in good condition throughout the life of the loan. Home maintenance expectations vary by lender and loan type, but typically include maintaining major systems and structural components like the roof, foundation, and plumbing, heating, and electrical systems.

If the home deteriorates to the point that it is no longer in good condition, lenders generally notify the borrower and provide a specified timeframe to complete the required repairs. However, if maintenance issues are not addressed within that window—even if they are neglected due to changes in a borrower’s financial situation—the lender may determine that the loan is due.

The borrower fails to pay property taxes or homeowners insurance

With both home equity conversion mortgages (HECM) and proprietary reverse mortgages, borrowers must remain current on property taxes and homeowners insurance. These ongoing costs are not covered by the reverse mortgage and remain the borrower’s responsibility.

If you fall behind on property taxes or homeowners insurance, the lender may advance funds to cover them and add this amount to your loan balance. Continued failure to pay property taxes or insurance premiums may result in the lender declaring the reverse mortgage due and payable.

The borrower no longer meets other loan obligations

In addition to occupancy, maintenance, and payment requirements, reverse mortgages may include other conditions outlined in the loan agreement. These tend to vary by lender.

It’s worth noting that proprietary reverse mortgages may include additional obligations beyond those required for HECMs. If a borrower no longer meets these requirements, the lender may call for repayment of the loan.

Repayment options for reverse mortgages

Most reverse mortgage borrowers repay the loan by selling the home, or by taking out a new loan, or using personal funds if they want to keep the property.

There are no prepayment penalties for home equity conversion mortgages (HECMs), which means you can repay the loan at any time—even before a triggering event occurs —using one of the options below. Understanding how repayment works can help you and your heirs plan ahead and avoid surprises.

Option 1: Sell the home and pay the reverse mortgage back with the proceeds

The most common way to repay a reverse mortgage is to sell the home and use the sale proceeds to pay off the loan. Any remaining equity belongs to the borrower or their family.

HECMs are non-recourse loans, meaning neither the homeowner nor their heirs will owe more than the home’s value when the loan becomes due and payable. If the home sells for less than the total loan balance, FHA insurance covers the difference.

If you or your heirs prefer to keep the home instead of selling it, the loan may be satisfied by paying the lesser of the full loan balance or 95% of the home’s current appraised value.

A non-recourse reverse mortgage transaction limits the homeowner’s liability to the proceeds of the sale of the home (or any lesser amount specified in the credit obligation). Non-recourse means that you, or your estate, can’t owe more than the value of your home when the loan becomes due and the home is sold. Non-recourse means that if you default on the loan, or if the loan cannot otherwise be repaid, the lender cannot look to your other assets (or your estate’s assets) to meet the outstanding balance on your loan.

These materials were not provided by HUD or FHA and were not approved by FHA or any government agency.

Option 2: Refinance the reverse mortgage loan balance

Some borrowers or their families choose to refinance the loan instead of selling the home. Depending on eligibility, financial circumstances, and long-term goals, they may opt for a traditional, forward mortgage or another reverse mortgage.

Refinancing may make sense for borrowers or heirs who want to keep the home and qualify for a new mortgage based on income, credit, and available equity.

Option 3: Take out a new loan

Another way to repay a reverse mortgage is to take out a different kind of loan, such as a home equity loan, personal loan, or even a traditional mortgage, and use the proceeds to pay off the balance.

This approach is more common for heirs who want to keep the home but prefer not to refinance into another reverse mortgage.

Finance of America does not currently offer home equity loans.

Option 4: Pay off the reverse mortgage in cash with your own funds

Borrowers and their heirs may also repay the loan with their own funds, such as savings or investment assets. This option may be practical for households with sufficient liquidity.

Option 5: Make voluntary payments while still living in the home

Many borrowers don’t realize they can make payments on a reverse mortgage at any time—not just after a triggering event. Partial payments can be applied to interest or principal, helping reduce the loan balance and preserving more home equity.

This approach is especially useful for borrowers who take a lump-sum payout for a large expense and want to slow balance growth thereafter. Making voluntary payments can provide flexibility and help address the misconception that borrowers are “locked in” until they move or pass away.

Option 6: Provide a deed in lieu of foreclosure

In some cases, borrowers or their heirs may choose to transfer ownership of the home to the lender through a deed in lieu of foreclosure. This allows the home to be turned over to the lender so the loan can be resolved without going through the formal foreclosure process. This option may be considered when other repayment options are not feasible.

Option 7: Use the right of rescission

After closing on a reverse mortgage, borrowers generally have a short period—typically three business days—to cancel the loan under the right of rescission. You can think of this as a period of reflection.

If you change your mind during this window and decide to exercise the right of rescission, the loan is voided and you must return any funds you received. The timeline for the right of rescission may vary by location–in California, for example, you have seven days. Learn more about how this works.

This chart can help you compare repayment options based on your profile and needs:

| Repayment option | Best suited for | When it’s typically used | Can you keep the home? |

| Sell the home and use sale proceeds | Borrowers or heirs who don’t plan to keep the home | After a triggering event* | No |

| Refinance the reverse mortgage balance | Borrowers or heirs who want to keep the home and qualify for new financing | After a triggering event* | Yes |

| Take out a new loan | Heirs who want to keep the home without another reverse mortgage | After a triggering event* | Yes |

| Pay off the loan with your own funds | Borrowers or heirs with sufficient savings or assets | Any time the loan is due | Yes |

| Make voluntary payments while living in the home | Borrowers who want to reduce balance growth over time | Any time during the loan | Yes |

| Provide a deed in lieu of foreclosure | Borrowers or heirs when other repayment options aren’t feasible | After a triggering event* | No |

The borrower must meet all loan obligations, including living in the property as the principal residence and paying property charges, including property taxes, fees, and hazard insurance. The borrower must maintain the home. If the homeowner does not meet these loan obligations, then the loan will need to be repaid.

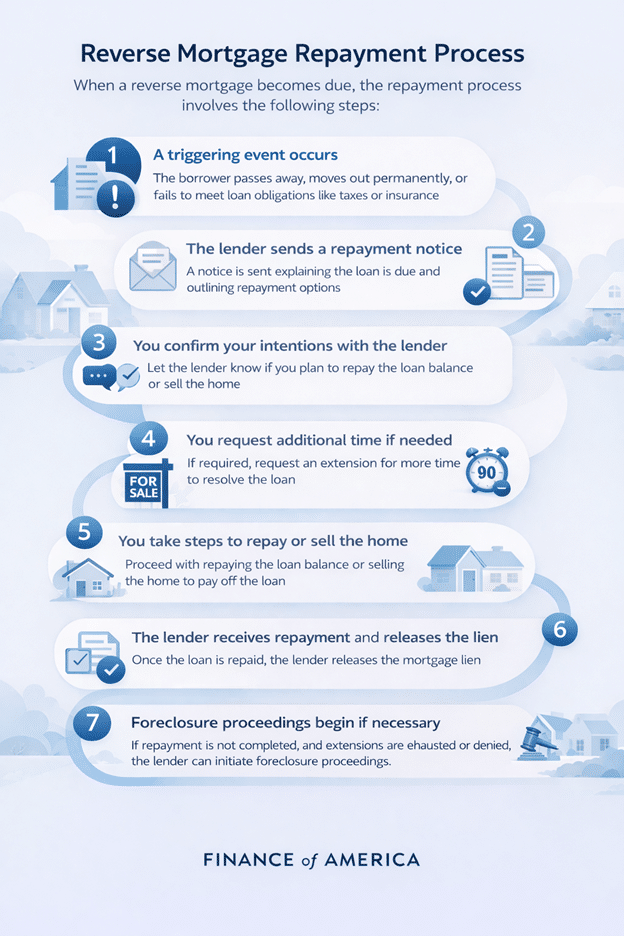

Reverse mortgage repayment process

When a reverse mortgage becomes due, repayment follows a structured process. Understanding how it works could help you and your heirs know what to expect, so you can respond confidently at each stage.

1. A triggering event occurs

The repayment process begins when a triggering event occurs. Common triggering events include the borrower passing away or moving to an assisted living facility, meaning the home is no longer the primary residence.

Another common reason for a lender to call for repayment is failure to meet loan obligations, including but not limited to paying property taxes, maintaining homeowners insurance, or keeping the home in good condition.

Once a triggering event occurs, the reverse mortgage loan becomes due and payable.

2. The lender sends a repayment notice

When the loan becomes due, the lender or loan servicer issues a formal repayment notice explaining the balance owed, the reason the loan became due, and the steps and timeline—typically 30 days—for repayment.

It may also detail potential repayment options and what documentation the lender needs from the borrowers or their heirs.

3. Borrowers confirm their intentions with the lender

After receiving the repayment notice, the borrower or their heirs must notify the lender of their intentions. This usually involves confirming whether they plan to keep the home by repaying the loan balance or selling the property to satisfy the debt.

Communicating your intentions as early as possible helps set clear expectations with the lender and may influence timelines or available options.

4. Borrowers request additional time if needed

If more time is needed to repay the loan or sell the home, borrowers or their heirs may request an extension. For HECMs, heirs can ask for additional time if they are actively working toward repayment or completing a sale.

Loan servicers often grant extensions in 90-day increments, up to the limits set by the Department of Housing and Urban Development (HUD), depending on circumstances and progress.

These materials were not provided by HUD or FHA and were not approved by FHA or any government agency.

5. Borrowers take steps to repay or sell the home

Once you confirm your intentions with the lender, you take concrete steps to resolve the loan. That typically includes one of two scenarios:

- If you are keeping the home: You may obtain financing, use personal funds, or refinance the loan balance into a new mortgage.

- If you are selling the home: You list the property for sale, coordinate with the lender, and follow required timelines and procedures outlined in the repayment notice.

Throughout this stage, communication with the lender is key to ensure you meet deadlines and avoid unnecessary delays.

6. The lender receives repayment and releases the lien

After the loan is fully repaid—either through sale proceeds or another repayment method—the lender issues documentation confirming that the loan has been satisfied. The lender then releases the mortgage lien, clearing the title to the property.

7. If repayment is not completed, foreclosure may begin

If repayment is not completed within the required timeframe—and extensions are exhausted or denied—the lender may initiate foreclosure proceedings. This is typically the final step in the process and occurs only after other repayment options have failed. We’ll cover more details on what happens during the foreclosure process below.

What heirs need to know about reverse mortgage repayment

When a reverse mortgage becomes due after a borrower’s death, heirs are not personally responsible for the debt. Still, they do need to understand their rights, responsibilities, and timelines. Knowing what options are available can help them make more informed decisions during an already difficult time.

Your rights as an heir

Heirs generally have three options when it comes to a reverse mortgage:

- Buy the home: Heirs may choose to keep the property by repaying the reverse mortgage loan balance with personal funds or by obtaining financing.

- Sell the home: Heirs can sell the property and use the proceeds to repay the loan. Any remaining equity belongs to the estate.

- Walk away: Heirs may choose not to keep or sell the home. In this case, the property is turned over to the lender, and the reverse mortgage is satisfied under the loan’s non-recourse protections.

Heirs are not required to repay a reverse mortgage using their own personal assets. And, because the loan is non-recourse, repayment is limited to the value of the home.

What if the loan balance exceeds the home’s value?

HECMs are non-recourse loans, which means the borrower or their heirs will never owe more than the home’s value. If heirs want to keep the home but the loan balance exceeds the home’s market value, they may be able to purchase the property for 95% of its appraised value.

If the home is sold for less than the loan balance, FHA insurance covers the difference, protecting both heirs and the borrower’s estate from additional liability.

A non-recourse reverse mortgage transaction limits the homeowner’s liability to the proceeds of the sale of the home (or any lesser amount specified in the credit obligation). Non-recourse means that you, or your estate, can’t owe more than the value of your home when the loan becomes due and the home is sold. Non-recourse means that if you default on the loan, or if the loan cannot otherwise be repaid, the lender cannot look to your other assets (or your estate’s assets) to meet the outstanding balance on your loan.

Timeline for repayment

After the borrower’s death, heirs have 30 days to respond to the lender and confirm their intentions. From there, they are typically given up to six months to repay the loan or complete the sale of the home.

For HECMs, family members may request extensions if they are actively working to repay the loan or sell the property. This may extend the total timeframe to 12 months, depending on HUD guidelines and the circumstances of the case.

These materials were not provided by HUD or FHA and were not approved by FHA or any government agency.

Can heirs negotiate with the lender?

Yes, heirs can often work with the lender or loan servicer, particularly when it comes to timelines and logistics. Communication is important, especially if delays arise as the estate is being sorted out, if the housing market is slow, or if financing takes longer than expected.

While lenders cannot change the underlying loan terms, they may be able to offer flexibility within program guidelines to help heirs complete the repayment process.

What happens when a reverse mortgage cannot be repaid?

If a reverse mortgage is not repaid after a triggering event and the borrower or their heirs miss deadlines, the loan may enter foreclosure. While foreclosure is typically a last resort, understanding how the process works can help borrowers and their heirs know what to expect.

The reverse mortgage foreclosure process generally follows these steps:

- The loan becomes due and payable: A triggering event occurs, such as the death of the last borrower or failure to meet loan obligations, and the full loan balance becomes due.

- The lender sends formal notices: The lender or servicer sends repayment and foreclosure notices, often via certified mail, outlining the outstanding balance, required actions, and deadlines.

- Opportunities to resolve the loan: Borrowers or their heirs may still be able to repay the loan, sell the home, or request extensions, depending on the loan type and circumstances.

- Foreclosure proceedings begin: If the loan remains unresolved, the lender may initiate foreclosure proceedings under state law.

- The home is transferred or sold: The property is ultimately sold or transferred to satisfy the debt, similar to other foreclosure processes involving a home equity loan or mortgage.

Foreclosure timelines and procedures vary by state and loan type. HECMs include additional consumer protections that may affect how the process unfolds.

→ Learn more in our guide, Reverse mortgage foreclosure: How it happens and what to do next.

Final thoughts on reverse mortgage repayment

Reverse mortgages must be repaid eventually, and understanding what leads to repayment can help borrowers and their heirs plan ahead with confidence. It’s important to remember you have options. Whether that means selling the home, refinancing the loan balance, using personal funds, or working with the lender on timelines, there are typically multiple paths to take. To explore potential scenarios, try our reverse mortgage calculator or speak with a reverse mortgage specialist to review your options.

FAQs about reverse mortgage repayment

Can a relative pay off a reverse mortgage?

Yes, a relative can pay off a reverse mortgage. This usually happens when an heir wants to keep the home and uses personal funds or financing to repay the loan balance.

Are there any tax implications when paying back a reverse mortgage?

Generally, repaying a reverse mortgage is not a taxable event because the loan proceeds are not considered income. However, tax situations vary, so it’s best to consult a tax professional for guidance specific to your circumstances.

Not tax advice. Consult a tax professional.

Can I negotiate the terms of repayment with the reverse mortgage lender?

Sometimes. While lenders can’t change the core loan terms, they may be willing to work with borrowers or their heirs on timelines, extensions, or sale logistics, especially for HECM loans.

Can you pay back a reverse mortgage early?

Yes. Most reverse mortgages, including HECMs, allow early repayment at any time without prepayment penalties, whether you’re paying down part of the balance or the full loan.

Do heirs inherit the reverse mortgage debt?

No, heirs do not inherit personal responsibility for the debt. They can choose to repay the loan and keep the home, sell the property, or walk away without owing more than the home’s value.

What happens if the home sells for less than the reverse mortgage balance?

If the reverse mortgage is a HECM, the loan is non-recourse, meaning neither the borrower nor the borrower’s heirs will owe more than the home’s value. FHA insurance covers the shortfall, which is part of the loan’s non-recourse protection.

A non-recourse reverse mortgage transaction limits the homeowner’s liability to the proceeds of the sale of the home (or any lesser amount specified in the credit obligation). Non-recourse means that you, or your estate, can’t owe more than the value of your home when the loan becomes due and the home is sold. Non-recourse means that if you default on the loan, or if the loan cannot otherwise be repaid, the lender cannot look to your other assets (or your estate’s assets) to meet the outstanding balance on your loan.

These materials were not provided by HUD or FHA and were not approved by FHA or any government agency.

How long do heirs have to repay a reverse mortgage?

Heirs typically have 30 days to notify the lender of their intentions and up to six months to repay the loan or sell the home, with possible extensions of up to 12 months for HECMs if they’re actively working toward a resolution. However, the timeline may vary by loan type or your specific circumstances.